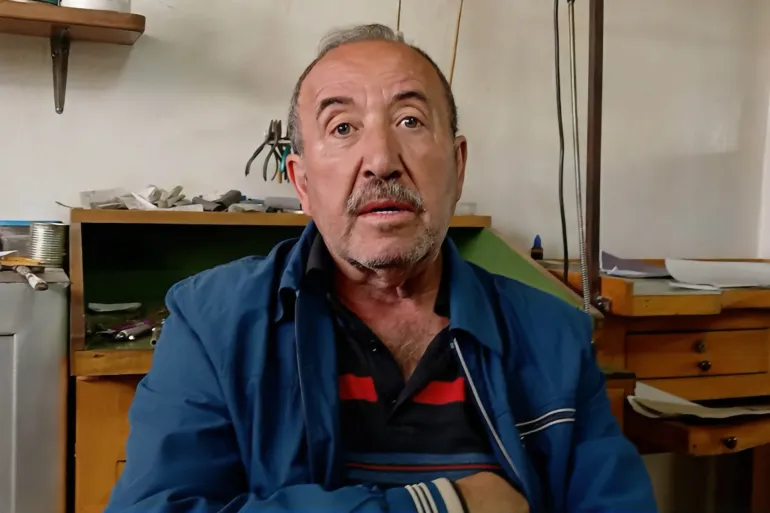

ساكو الأخير.. حكاية الذهب اليدوي في عنجر اللبنانية

“الأرمن ذهب لبنان”، هكذا يختصر ساكو شانكيان، أحد آخر الحرفيين الأرمن، علاقته بحرفة صياغة الذهب اليدوي، التي تحتضر ببطء في لبنان، كما هي الحال في العالم أجمع.

هذه المهنة التي كانت ركيزة اقتصادية وثقافية لجالية أرمنية عريقة، تنزوي اليوم تحت وطأة آلات المصانع الحديثة، التي تنتج آلاف القطع في ساعات، لكنها تفتقر إلى “الروح”، على حدّ تعبيره.

من حلب إلى عنجر

وترتبط علاقة الأرمن بحرفة صياغة الذهب يدويا بتاريخ نزوحهم الكبير من تركيا إلى لبنان عام 1920. يومها، حملوا معهم أدواتهم ومهاراتهم وأسّسوا نواة لقطاع اقتصادي مهم في بيروت، بلغ ذروته في ستينيات القرن الماضي بسوق الذهب الملاصق لساحة الشهداء، الذي تحوّل إلى مقصد للسياح العرب والأجانب، حتى في أوج الحرب اللبنانية.

يستعيد ساكو ذكرياته قائلا إنّه تتلمذ على يد دانكستو هانكسيان وريج دارنبايان في أربعينات القرن الماضي، وكانا أول من أنشأ ورشا لصياغة الذهب يدويا في الأشرفية والدورة، قبل أن تنتقل لاحقا إلى برج حمود.

ويضيف في حديثه للجزيرة نت: “توسّعت المهنة مع قدوم آل بوغوصيان من حلب، وازدهرت بسرعة في عنجر ضمن التجمعات الأرمنية”.

بين التكنولوجيا والشغف.. الحرفة في مهبّ الريح

لكن ذلك العصر الذهبي بات من الماضي. “لم يبقَ من الحرفيين اليدويين إلا قلة قليلة”، يقول ساكو بأسى. ويشرح أن السوق اللبناني بات يعجّ بذهب مستورد من تايوان والصين، في حين تنتج نحو 400 ورشة حديثة آلاف القطع يوميا، مما دفع بحرفته نحو التراجع الكبير: “كنت أُصنّع أو أرمم 20 كيلو سنويا، أما اليوم فلا أُنجز أكثر من كيلوين”.

ويمتد الوجود الأرمني في لبنان لأكثر من 3 قرون، لكن الموجة الأكبر من النزوح كانت بين عامي 1916 و1939. واليوم، يتراوح عدد الأرمن اللبنانيين بين 150 و160 ألفا، يشغل بعضهم مناصب سياسية، ويتمسكون بلغتهم وهويتهم وحرفهم، وعلى رأسها صياغة الذهب. فهل هناك جيل جديد يحمل الشعلة؟

يؤكّد ميكيل شانكيان (نجل ساكو) أنّه يتعلّم أسرار المهنة من والده، ويعمل على تطوير مهاراته لإحياء هذا التراث: “أؤمن بوجود زبائن يقدّرون الخاتم أو العقد المصنوع يدويا، لأنه يحمل فنا راقيا وجودة عالية، ويُكمل شخصية من يرتديه”.

رغم اعترافه بصعوبة مواجهة التكنولوجيا الحديثة، يشير شانكيان إلى أنّ ارتفاع سعر كيلو الذهب إلى 100 ألف دولار يمثل عائقا كبيرا، يُضاف إلى اكتساح المعامل الكبرى للسوق. لكنه يصرّ على الاستمرار: “أنا مُصر على المواجهة كي أرضي ضميري، وأحافظ على ريادة أهالي عنجر في هذا المجال”.

ماذا يقول خبراء السوق؟

يشير هادي جبارة، خبير تصنيع الذهب وتقييم الألماس، إلى أن العثور على حرفيين يدويين أصبح أمرا نادرا: “نواجه صعوبة في تلبية طلبات بعض الزبائن، خاصة المغتربين وهواة القطع الفريدة”.

ويضيف للجزيرة نت “نحن في زمن التكنولوجيا الحديثة، يجب أن نكون واقعيين. السوق اللبناني يعتمد كليا تقريبا على إنتاج المعامل الحديثة، التي يديرها محترفون معظمهم من الأرمن”.

ويلفت جبارة إلى أن القطاع يشهد نموا كبيرا داخليا، بسبب لجوء اللبنانيين إلى الذهب كملاذ آمن في ظل الأزمة الاقتصادية، ويضيف: “لامس حجم التصدير إلى الخارج 90% من الكميات المصنعة محليا أو المعاد تصديرها”.

لكن رغم هذا النمو، فإن جبارة يعترف بأن المنتج الآلي لا يضاهي في قيمته الفنية القطع المصنوعة يدويا: “الآلات تنتج ألف خاتم مرصع بالألماس خلال ساعات، لكن السوق لا ينتظر أحدا”.

ويبقى السؤال مطروحا: هل تُنقذ الدولة اللبنانية، أو حتى مؤسسات المجتمع الأرمني، هذه الحرفة قبل أن تندثر؟ وهل يجد الجيل الجديد ما يكفي من الشغف والدعم ليواصل طريق ساكو، آخر الحرفيين في عنجر؟