China’s young billionaires are riding the tech boom. Here are the 20 richest

China’s young billionaires amassed a combined fortune of more than $223 billion this year as the country enjoyed its fastest year of wealth accumulation, even as the world battles its worst economic crisis in decades.

China had 60 billionaires below the age of 40 this year, according to the latest Hurun Rich List released last week. Of them, 14 joined the billionaire club for the first time in 2020, as a tech-fuelled stock market surged and a spate of IPOs paved the way for wealth growth amid the coronavirus downturn.

The uptick mirrors a wider unprecedented surge in the fortunes of China’s uber-wealthy, with the country now home to 878 billionaires with a combined wealth of $4 trillion. A decade ago in 2010, the country counted just 189 billionaires.

“The world has never seen this much wealth created in just one year. China’s entrepreneurs have done much better than expected. Despite Covid-19, they have risen to record levels,” said Rupert Hoogewerf, Hurun Report chairman and chief researcher.

Now in its 22nd year, the annual Hurun ranking seeks to provide a “snapshot of wealth” in the world’s second-largest economy as of Aug. 28. Focusing on both wealthy individuals who were born and brought up in mainland China, as well as individuals born outside of mainland China but who reside there today, the report draws on data and interviews in what it labels “as much an art as it is a science.”

CNBC Make It took a look at China’s 20 wealthiest billionaires under 40.

China’s richest young billionaires

1. Huiyan Yang and family, 39, Country Garden

Net worth: $33.1 billion

Topping the list again this year is 39-year-old Huiyan Yang and her family. Also considered Asia’s richest woman, Yang is the majority shareholder of Country Garden, a property development company founded by her farmer father, Guoqiang Yang, in Guangdong in 1992.

Despite seeing her wealth surge 29% over the past year, Yang dropped one spot in 2020 to rank as China’s sixth-richest billionaire overall.

2. Zetian Zhang, 27, JD.com

Net worth: $23.5 billion

Zetian Zhang, 27, and her husband Qiangdong Liu, 41, saw their combined wealth surge 111% to $23.5 billion in 2020 largely thanks to the meteoric growth of Liu’s e-commerce company JD.com. A businesswoman in her own right, Zhang is an investor who also serves as chief fashion advisor of JD’s luxury business. At 24, she became China’s youngest female billionaire following her marriage to Liu in 2015.

3. Hao Yan, 34, Pacific Construction Group

Net worth: $21.3 billion

Hao Yan, 34, is the chairman of Xinjiang-headquartered construction company Pacific Construction Group, the company founded by his father, CEO JieHe Yan in 1986.

4. Yiming Zhang, 37, ByteDance

Net worth: $16.2 billion

37-year-old Yiming Zhang is the co-founder and CEO of ByteDance, the Chinese internet company behind video sharing platform TikTok. The platform has shot to prominence outside of China, now surpassing Facebook-owned Instagram to rank as U.S. teens’ preferred social media app after Snap. However, its rapid growth has also sparked national security concerns, prompting the proposed sale of its U.S. operations.

5. Bangxin Zhang, 39, TAL Education

Net worth: $14 billion

With an estimated net worth of $14 billion, Bangxin Zhang is the co-founder and chairman of Beijing-headquartered tutoring business TAL Education. Founded in 2003, the company went public on the New York Stock Exchange in 2010 and has enjoyed rapid growth in 2020 under coronavirus-induced remote learning policies.

6. Gang Zhang and family, 39, Xinfalyudian

Net worth: $8.8 billion

39-year-old Gang Zhang of aluminum company Xinfalyudian has an estimated net worth of $8.8 billion, having grown his fortunes 100% in the past year and jumping up 32 places in the overall 2020 rich list.

7. Xiaosong Wang, 33, Seazen

Net worth: $6.4 billion

Xiaosong Wang is the 33-year-old chairman and president of real estate company Seazen. Wang shares the fortune with his father, Zhenhua, 58 whom he replaced in 2019 following accusations of sexual assault.

8. Qun Wu, 32, Yuwell

Net worth: $5.3 billion

Qun Wu, 32, is the son of Guangming Wu, 58, founder and chairman of medical equipment maker Yuwell. Together they have a fortune of $5.3 billion, up 50% from last year.

9. Gang Ye, 39, Sea

Net worth: $4.9 billion

New to this year’s list is China-born Gang Ye, who made his fortune in Singapore as one of the co-founders of internet company Sea. As the developer behind popular gaming apps such as Free Fire, Sea has benefited from a surge in gaming under lockdowns this year, becoming the world’s best-performing large-cap stock in August.

10. Hua Su, 38, Kuaishou

Net worth: $3.8 billion

Chinese entrepreneur Hua Su founded Kuaishou as a GIF-making app in 2011 but later transformed it into a video sharing platform popular with users particularly in rural China. Before founding the company, he worked as a programmer at Google and Chinese internet search engine Baidu.

11. Meng Yang, 38, and Li He, 36, Anker

Net worth: $3.7 billion

Newly-minted billionaires Meng Yang and Li He saw their combined wealth catapult to $3.7 billion this year on the back of their consumer electronics company, Anker. The Apple charger-maker doubled in valuation when it debuted on the public market this August, hitting $8 billion.

12. Xiang Li, 39, Li Auto

Net worth: $3.5 billion

Dubbed “China’s Elon Musk,” 39-year-old Xiang Li is the founder of electric vehicle-maker Li Auto. Founded five years ago, the Beijing-headquartered manufacturer went public on the Nasdaq in July 2020 with a valuation of $10 billion, catapulting Li to billionaire status.

13. Liang Zhang, 38, R&F

Net worth: $3.45 billion

Liang Zhang is the 38 son of Li Zhang, 68, founder and co-chair of Guanzhou-based developer R&F. Together, their wealth totals more than $3.4 billion.

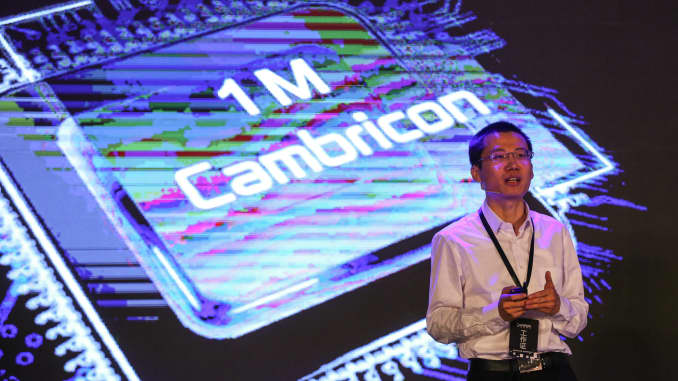

14. Tianshi Chen, 35, Cambricon Technologies

Net worth: $3.1 billion

Newcomer to this year’s list is Tianshi Chen, the 35-year-old co-founder and CEO of chipmaker Cambricon Technologies. Launched in 2016, the company’s artificial intelligence-enabled technology has been used in more than 100 million smartphones.

15. Yixiao Cheng, 35, Kuaishou

Net worth: $3.1 billion

Also new to the list is 35-year-old Yixiao Cheng, co-founder of short video platform Kuaishou. Cheng, who began his career as a software engineer at HP, now has an estimated net worth of more than $3 billion.

16. Yifeng Wang, 36, Zhejiang Century Huatong Group

Net worth: $3.1 billion

Yifeng Wang, 36, and father Miaotong Wang, 63, are the vice-chairman and chairman, respectively, of automaker Zhejiang Century Huatong Group. Having recently diversified into games development, the pair has seen their combined wealth surged 83% in the past year.

17. Wei Cheng, 37, DiDi

Net worth: $2.8 billion

37-year-old Wei Cheng is the founder and CEO of ride-hailing giant DiDi. Having spent eight years working at Chinese e-commerce giant Alibaba Group, Cheng launched DiDi in 2012. Today, the company ranks as one of China’s most valuable billion-dollar start-ups and Cheng is worth an estimated $2.8 billion.

18. Guoyuan Peng, 34, NWY

Net worth: $2.6 billion

Guoyuan Peng, 34, is the chairman of education group NWY, worth an estimated $2.6 billion, up 20% from 2019.

19. Zheng Cao, 37, Hangke Technology

Net worth: $2.5 billion

Zheng Cao, 37, is the vice president of Zhejiang Hanke Technology, the lithium battery producing company founded by his father Ji Cao, 68. With a shared 70% stake in the business, the pair is today worth an estimated $2.5 billion.

20. Yan Wu, 39, Hakim Unique

Net worth: $2.5 billion

Yan Wu, 39, and husband Qicheng Wang, 40, are the co-founders of Hakim Unique, an internet, media and real estate company. Together, their fortune is around $2.5 billion.

CNBC